Financial advice in Australia

Updated on 17 October 2023

6 min read

More than half of Australians have started getting financial advice or seeing their adviser more often. Why? Our research shows it's all to do with the economy.

Our research has found more than 1 in 2 Australians (56%) have started getting professional financial advice – or started seeing their adviser more often. And it’s all to do with recent economic events. So, what is financial advice? And can you get financial advice for free?

What is financial advice?

Financial advice is when a qualified, licensed adviser helps you decide what to do with your finances to reach a certain goal. You could get advice on part or all of your money.

There are 2 types of financial advice in Australia.

-

Personal advice is specific to your financial situation, needs, and goals. Example: An adviser could tell you which debts to pay off first, what to invest in, or whether to claim a tax deduction on an investment.

-

General advice is information about what's worked well for people in the past, and what's expected to work in the future. Example: Our website explains how salary sacrificing into super can be tax-effective for people who earn more than $45,000 a year.

The right advice is more important than ever

So many people are feeling the pinch of inflation. The cost of living is rising. And the housing affordability crisis is adding extra stress to finances.

Saving for longer term goals seems even harder.

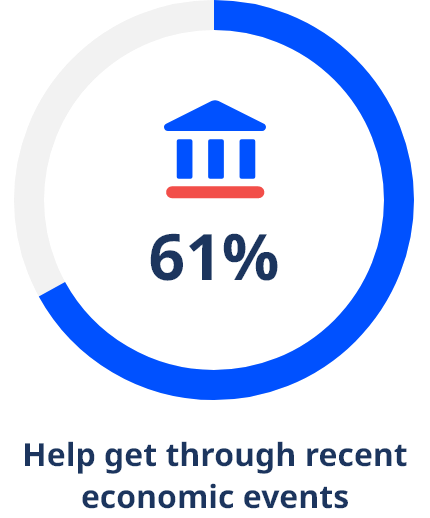

More than 3 in 5 people believe advice could help them get through these tough times (61%). But sadly, only some can afford to get advice.

Younger Australians are the most likely to have started getting advice more regularly because of recent economic events. Here's the breakdown:

- 67% of Gen Z (born 1997–2012)

- 72% of Millennials (born 1981–1996)

- 48% of Gen X (born 1965–1980)

- Only 25% of Baby Boomers (born 1946–1964)

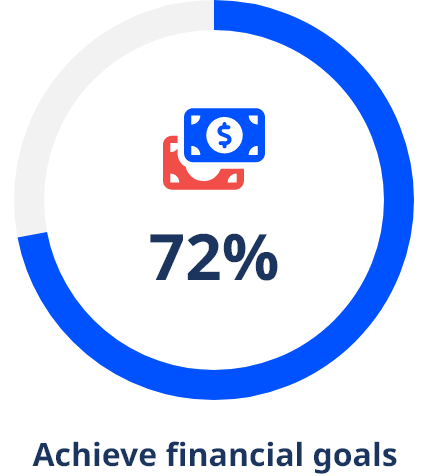

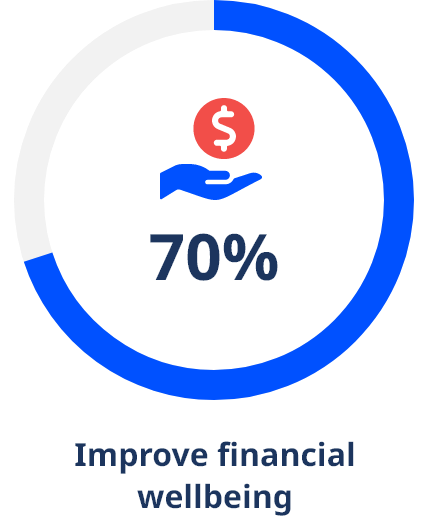

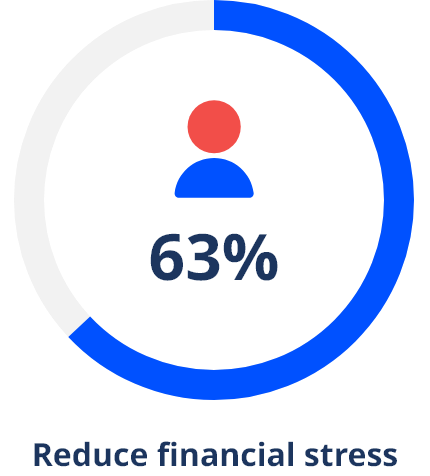

Australians we surveyed say getting financial advice can...

Source: YouGov and Australian Retirement Trust, Finance and Superannuation, 2022. Surveyed 2,000 Australians.

What can you get financial advice about?

Some of the topics you can get financial advice about include:

-

Superannuation

-

Investing your money

-

Savings, budgeting, and cash flow

-

Planning your retirement (when to retire, products for your needs, etc.)

-

Estate planning (why you need a Will, beneficiaries for any super accounts, etc.)

-

Insurance (life insurance, income protection insurance, etc.)

Aged care financial advice

There are a number of companies and firms across Australia that specialise in financial advice for aged care.

Centrelink's Financial Information Service also offers some free aged care advice.

When it comes to hiring aged care services, the government's My Aged Care website can help you find a provider.

Retirement financial advice

Our research found more than half (52%) of Australians start looking for professional financial advice more regularly as they get closer to retirement age.

Your membership with us includes financial advice throughout your retirement.

And we can give financial advice when you're planning ahead. Topics include:

-

Estimating if you're on track for retirement

-

Advice on transition to retirement strategies

-

Managing your Australian Retirement Trust Super Savings account

-

How to replace your salary with regular income in retirement

-

Understanding how the Age Pension works with your super.

Find out more about your advice options.

Financial advice for women

Women and non-binary people in Australia face particular challenges when it comes to finances, and the gender pay gap is still very real.

Search for a financial adviser in your area on the Financial Advice Association Australia website. You can usually ask for a free call from an adviser to see what they can help you with and how much they cost.

Depending on which state or territory you live in, the government has support services that might help:

- New South Wales: Women NSW's Financial Toolkit has online resources to help manage your finances.

- Queensland: Financial First Aid Line gives emergency financial advice for women.

- Victoria: WIRE gives free information, support, and referrals for women, non-binary people, and gender-diverse people.

Financial advice on inheritance

If you've just inherited some money from a loved one, you may want financial advice to help you decide the best way to invest that money.

You might be thinking of real estate property investment, for example. Or need help with how to invest on behalf of a minor.

Or you could be looking for inheritance advice if you're preparing your own Will. Deciding who should inherit your money when you die isn't always straight forward.

A financial adviser can help you find the best way to manage your money, including tax-effective methods.

A solicitor is a better option if you need help to create and maintain your Will, or with any disputes over a loved one's estate.

Where to get financial advice in Australia

There are plenty of firms around Australia with professional financial advisers and financial planners. When choosing one, check an adviser's licence and qualifications on the government's Financial Advisers Register.

You can often get financial advice from your bank about things like budgeting and home loans. Your super fund can give you advice about superannuation, insurance, and retirement.

If you're a member with us, one of our qualified financial advisers can help with your super, planning for retirement, and managing your income in retirement. It's all included in your membership.

If you need financial advice about more than your super, you can choose your own adviser, or we can refer you to an accredited adviser on our National Advice Panel.

Find out more about how to get advice with us, or read on for more places to get financial advice.

This depends on whether the accountant has an Australian Financial Services (AFS) licence or if they're an authorised representative of someone with an AFS licence.

If they're licensed, a chartered accountant (CA) or certified practising accountant (CPA) can give advice about tax or investments.

Business Queensland says an accountant can also give you advice about running a business. This includes buying or selling a business, business activity statements (BAS), tax deductions, paying your employees' superannuation, and more.

A financial planner who is a qualified tax relevant provider with ASIC and has an Australian Financial Services licence can give tax advice.

You can look up their qualifications in the Tax Practitioners Board registry.

Mortgage brokers are not financial advisers. Their role is to offer you a range of home loans and help you understand what each loan type offers.

They can't give you advice on which loan to choose or what to do with your money in general.

When it comes to the banks and credit unions, you can often get free financial advice from them about things like budgeting, savings and term deposits, credit cards and home loans.

Of course, they may only be able to promote their own products to you. So it's worth doing your own research about what other products are out there.

Lawyers and solicitors aren’t able to give financial advice in Australia unless they have a financial services licence.

A lawyer can tell you if they think you need to see a financial adviser. And they can recommend a financial adviser or planner.

Cost of financial advice

The most common reason people don't see a financial adviser is the cost.

57% of Australians say it's just too expensive.

About 2 in 5 people (39%) also feel like they don't have enough money or investments to justify needing advice.

Other things people say stops them from getting advice include:

-

Not knowing who to trust (36%)

-

Feeling like they can manage their finances themselves (33%)

-

Not knowing how or where to start (22%)

-

Thinking it's too complex or difficult (14%)

If the financial advice cost is what worries you, you have a variety of options that can help.

Free financial advice

Australia now has a few free options, such as Centrelink financial advice (the Financial Information Service).

Then there's the free National Debt Helpline (1800 007 007). And the Mob Strong Debt Helpline for Aboriginal and Torres Strait Islander people (1800 808 488).

Moneysmart also has links to financial counsellors who can help if you run a small business or farm, or live in a rural area.

Your membership with us also includes personal financial advice about your super account.

Is financial advice tax-deductible?

In general, you can claim a tax deduction for advice fees if you get advice about an investment that earns you income.

But an advice fee isn't tax-deductible in some cases. This includes if you pay the fee from your super balance, or a fee for ongoing advice.

Check with your financial adviser or the ATO about which fees you can claim.

Ready to create a better future?

When you're a member with Australian Retirement Trust, you get personal financial advice about your accounts with us. We’re here to help get your super on track.

Join today

See advice options