How super is invested can have a big impact on how much our members may have in retirement. That’s why it's important to look at the long-term performance of investments to help grow their super.

Our scale and size mean we can invest in a broad range of local, national and global investment opportunities, with our team of investment experts focusing on delivering strong and competitive investment returns over the long term, working hard to navigate changing markets and keep members’ retirement savings on track.

How we invest members’ super

At Australian Retirement Trust, members have flexibility to choose from a range of investment options, however if they don’t make an investment choice, we’ll invest their super in our MySuper investment option – the Lifecycle Investment Strategy.

In the Lifecycle Investment Strategy, if they’re under 50 years of age, we invest their super in the High Growth Pool. The High Growth Pool has identical objectives, risk labels and asset allocations as our award-winning High Growth option. The High Growth Pool has a growth asset ratio of around 85% - shares are an example of a growth asset.

Our High Growth Pool delivered a 9.49% p.a. return over the past 10 years to 30 September 2024.1

Super is a long-term investment

Investment strategies that aim for the highest returns on members’ money generally have the highest risk of ups and downs in the short term. Strategies with lower returns are generally lower risk. So, there’s a risk and return trade-off:

- High-growth assets have the potential to deliver strong medium- to long-term returns. The trade-off is that they carry a higher risk of short-term losses.

- Defensive assets have a lower chance of making losses. The trade-off is that they generally deliver lower returns, sometimes not even enough to keep up with inflation. Cash is an example of a defensive asset.

Super is a long-term investment and generally speaking, Australians can’t access their super until they reach their preservation age, which for most people is now 60 years of age. Those under 50 in particular have the opportunity ride out the ups and downs of the market, smoothing out returns over the long-term, and generally producing higher returns.

What happens when a member turns 50?

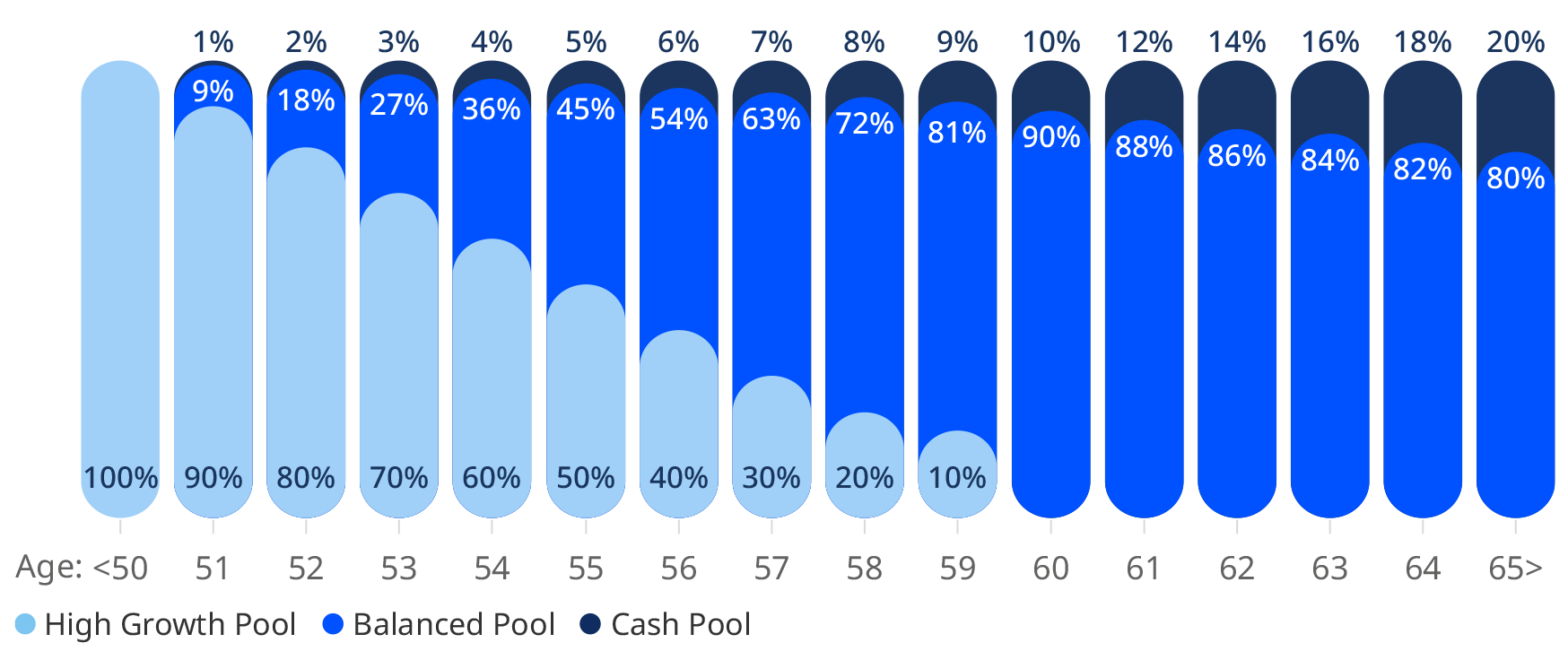

In Australian Retirement Trust’s Super Savings Lifecycle Investment Strategy, we’ll invest 100% of a member’s account balance in the High Growth Pool until they turn 50.

Following their 50th birthday, the balance will move gradually out of the High Growth Pool into the Balanced and Cash Pools, as shown in the following graph.

By their 60th birthday, the balance will be invested in a combination of the Balanced and Cash Pools. The proportion allocated to the Cash Pool will then gradually increase as they approach age 65. This strategy reduces investment risk as they approach retirement.

Indicative image only. Read the Super Savings Investment Guide available on your employer microsite for full details of how the Lifecycle Investment Strategy works.

Investing super to meet a member’s goals

If a member prefers to choose their investment options, they can invest in our new streamlined suite of Choice investment options. On 1 July 2024, we released 15 new carefully constructed Choice investment options that cover a broad range of objectives and investment timeframes to meet different members’ goals and life stages.

Before making any changes, members should consider their unique retirement goals and financial needs when working out which investment option might be right for them. When investing in super, members should consider:

- their investment timeframe

- the level of returns they want

- how much risk they’re willing to take.

All investments carry risk. This means there’s a risk that the value of investments might go down as well as up. Generally, the longer members have before they want to start using their super, the more they might choose to invest in higher-growth, higher-risk options. This is because they may be wanting to grow their money as much as they can over the long term, and this might matter more than any short-term falls or fluctuations.

But if a member is close to being eligible to access their super, they may choose to invest more conservatively. This is because they might want to help protect their retirement savings from any short-term losses.

Learn about ART’s investment options

1. The High Growth Pool commenced on 1 July 2024 and has identical investments to the High Growth option. To show the returns for the High Growth Pool, we have shown the returns of the High Growth option to 1 July 2024, and the returns of the High Growth Pool from 1 July 2024. The High Growth option commenced on 28 February 2022 and adopted the investment strategy of the pre-merger Sunsuper Growth option.