If you only check your super once a year, there’s no better time than when you get your Annual Statement.

With Statements going out in October and November, here are some important things to look for when you’re reading it. And don’t worry, if you haven’t seen your Annual Statement yet, you can get your Annual Statement any time through Member Online. Here’s how:

- Log in to the ART app

- Select More (the three dots…)

- Select ‘Your account' then 'Statements and letters'

- Choose your Annual Statement notification (make sure it's the PDF).

Note: For Member Online through the website, skip Step 2.

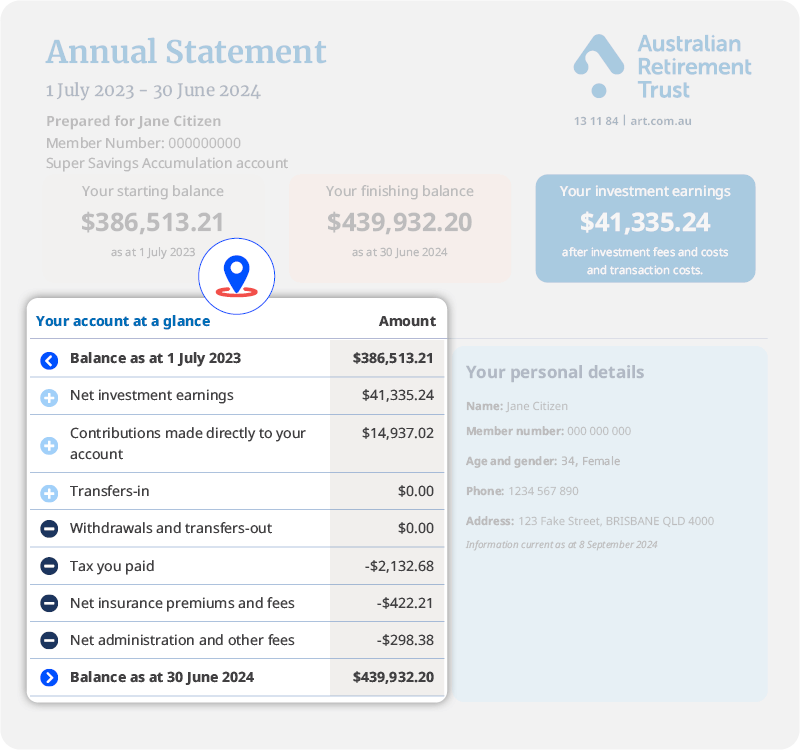

1. Your account at a glance

On the first page of your Annual Statement is ‘Your account at a glance’ – showing your account balance at the beginning of the financial year (or the date your account was opened), compared with your closing balance at the end of the financial year. This table also shows the transactions and net investment earnings that contributed to your closing balance for the year.

More information is included in your Annual Statement.

2. Your personal details

The personal details section on your statement contains the following:

- Your member number, which is unique to you – like your bank account number.

- Your age, gender and contact details

Check to see if your details are correct. If you need to make any changes you can do this through Member Online.

If you’re not already registered for Member Online, it’s simple to do. It’s the easiest way to keep up to date with your superannuation investments, contributions, insurance and account balance. Get started here.

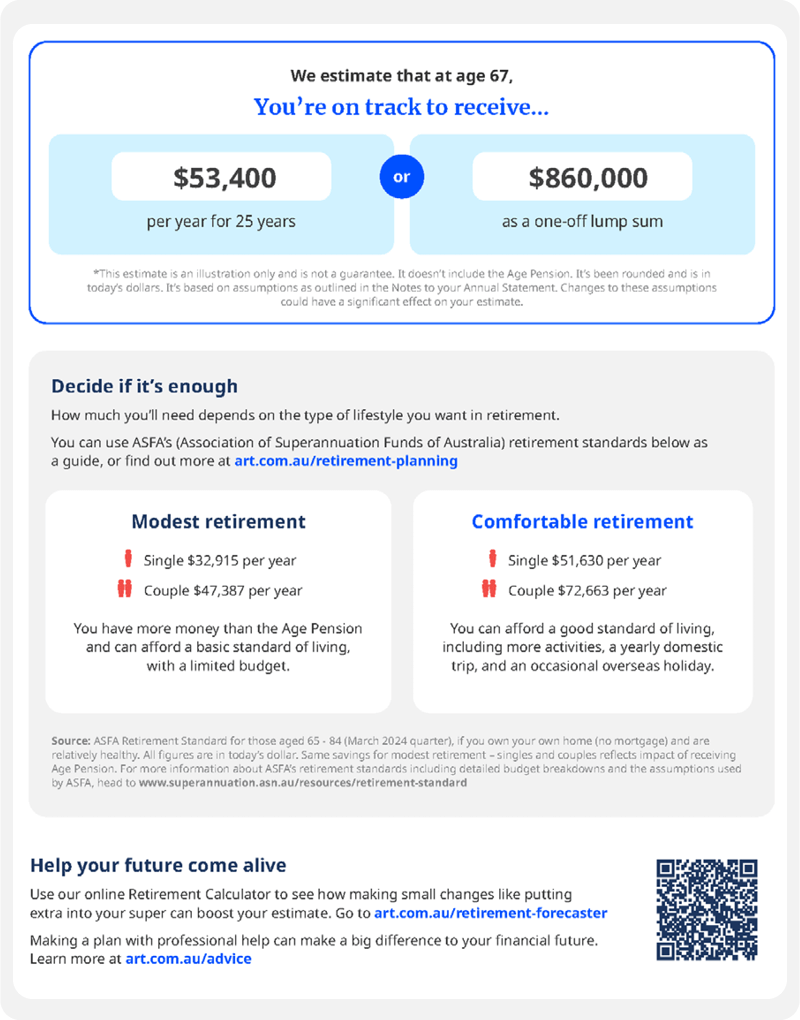

3. Retirement forecaster

This year we’ve included a retirement forecaster in most Annual Statements. Based on your account information we estimate what your super balance might be when you reach age 67.

Note: Not all Annual Statements will contain this forecasting tool. There's a number of reasons why some Annual Statements won't include a forecast. The most common are that you already have an income account, or there's account information that we believe would make your estimate inaccurate.

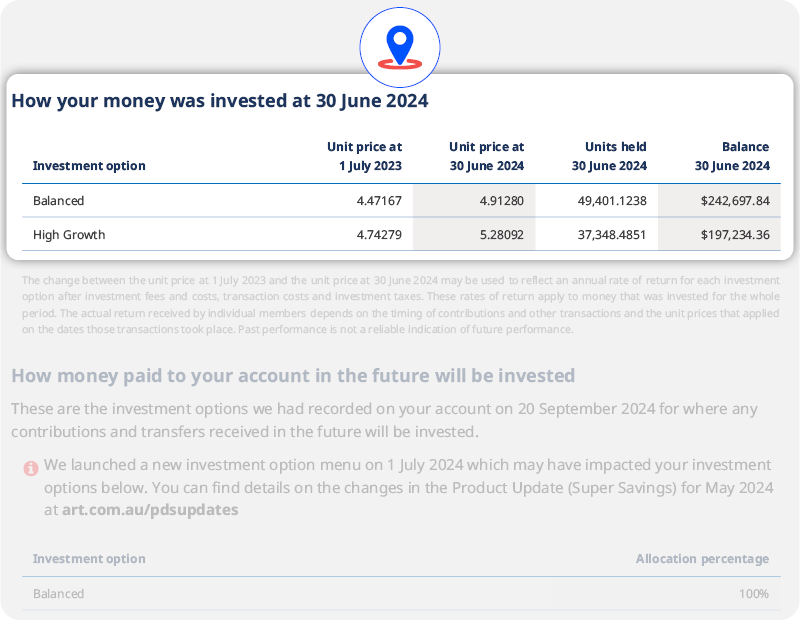

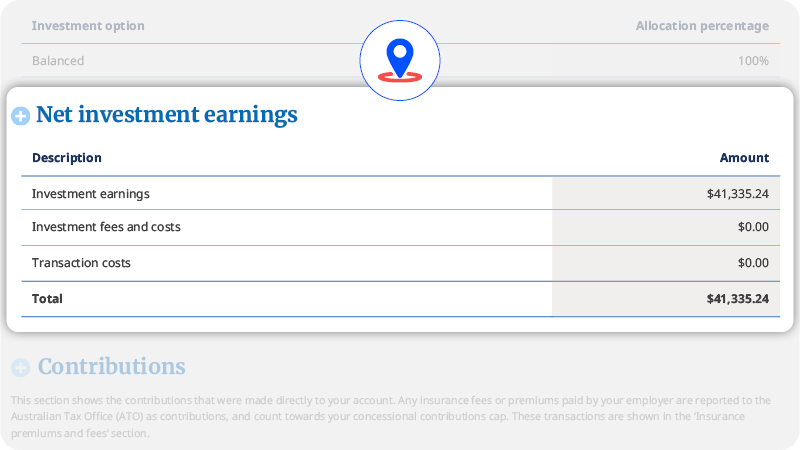

4. Check how your money was invested

This section shows where your money was invested and the value of your holdings in that investment option at the end of the financial year. A unit is like a ‘share’ in a company, except in this case you buy units in your chosen investment option(s). For more information on Unit Price calculations refer to the Notes to your Annual Statement

The investment section will also show how much your investments earned and the net return after fees and costs to 30 June 2024.

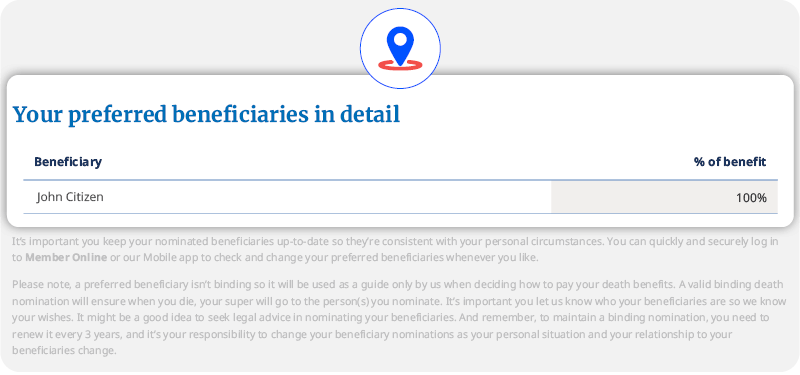

5. Check your beneficiaries

You can nominate a beneficiary to let us know who you would like to receive your super when you die.

Your super doesn’t automatically form part of your estate so it’s important you make sure this information is up to date, especially if your circumstances or relationship with your beneficiaries has changed. Importantly, your binding nomination may have expired, so check the expiry date and make sure it is still valid.

Read more on beneficiary nominations here.

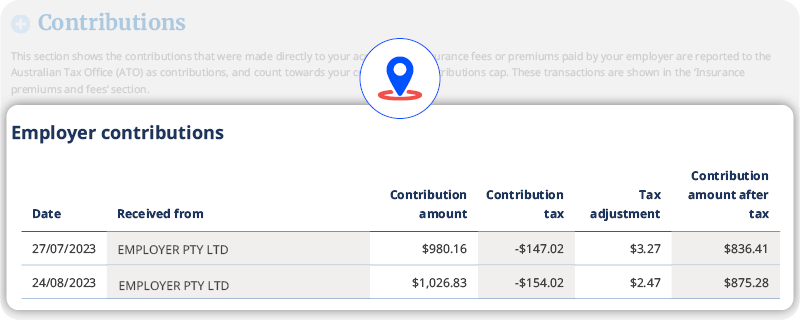

6. Review your contributions

Your statement also includes detailed information about the transactions made on your Super Savings account during the year.

If you’re employed, check to make sure you’ve received regular contributions from your employer. If you’re topping up your super with salary sacrifice or voluntary contributions (after-tax), or you’ve rolled money in from other super funds, make sure they’re on there too.

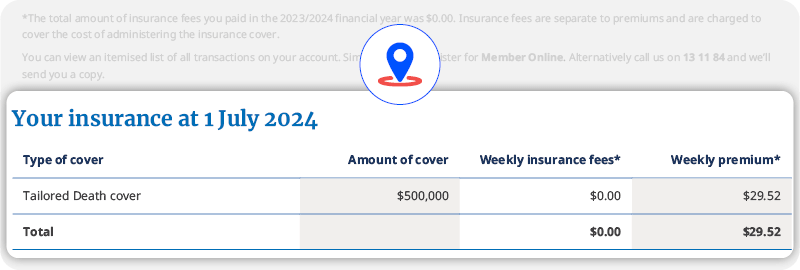

7. Check your insurance

Your Annual Statement will include what insurance applies to your account, how much you’re covered for, and your fees and premiums. If you wish to change your insurance in your super, you can do so in Member Online.